Commercial or Personal Vehicle?

A commercial vehicle is any car, van, or truck used for business purposes.

If you don’t have a vehicle specifically for commercial use, but drive your personal car for business, is that still considered a commercial vehicle? Probably. When you use any vehicle for a business operation, it is a good idea to get a New York commercial auto insurance policy to ensure that you are covered for any incidents that may occur during business operations.

Don’t rely on your personal policy to cover business-related accidents, as there may be specific exclusions for commercial use of your car or truck that could leave you with major out-of-pocket costs after an accident.

Commercial vehicles often come with a higher risk, which requires a separate policy. If you have a fleet of commercial trucks that deliver hazardous materials, for example, you will need specialized commercial truck insurance that covers your specific liability risks.

Your commercial vehicle policy can help protect your business financially in the event that you or one of your drivers causes an accident on the road. Whether the accident results in minor property damage or severe injuries to others, you will be protected from major costs for repairs, medical treatment or even a lawsuit. Your policy can also cover your costs if one of your vehicles is damaged after an accident, severe weather and other hazards

How Much Commercial Auto Insurance Do I Need?

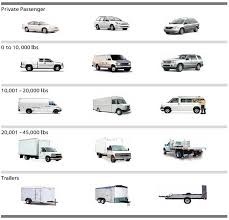

New York State law requires that all commercial trucks and vehicles be insured with a minimum amount of commercial auto liability insurance. But you may also want additional coverage based on your company's needs and risks. The business owner that has a small car to meet with clients will need a different policy than a company that has a fleet of garbage and recycling trucks. Here are some questions to help you determine what kind of coverage you need.

- What kinds of vehicles does your company use?

- Who owns these vehicles?

- Who drives the vehicles?

- How often are the vehicles driven?

- What are you transporting?

Don’t let an uninsured accident ruin everything you’ve built. Westrock Insurance will find you a commercial insurance policy that matches your needs and budget. We will help you determine the type and amount of coverage you need based on the vehicles your company owns, the experience and training of your drivers, and other factors unique to your business. Click here to find out how.